About

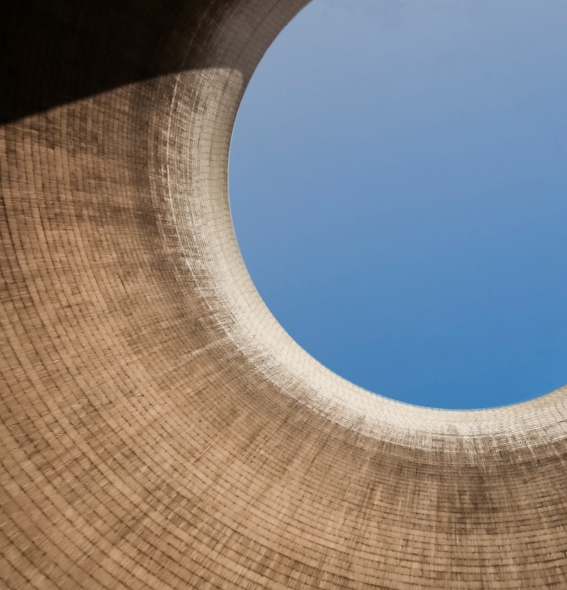

Carbon Infrastructure Partners is a private equity firm targeting risk-adjusted returns across the carbon life cycle, from responsibly sourced energy production to industrial decarbonization

Our two distinct fund strategies enable investors to position both for the transition to net-zero carbon emissions and increased global demand of responsibly sourced energy.

Our history

While Carbon Infrastructure Partners was founded in 2020, the team invested together for almost 14 years under the entity JOG Capital, a private equity firm that has invested $1.3bn CAD in energy startups across six funds.

Why Invest In Industrial Decarbonization?

DUMPING CARBON INTO THE ATMOSPHERE IS UNSUSTAINABLE.

The industrial revolution and our use of energy-dense hydrocarbons has driven prosperity for the global population of 7.9 billion people. Unrestricted emissions of greenhouse gases are accumulating in the atmosphere, contributing to climate change.

Industrial decarbonization focuses on solving for the variable of carbon – finding creative ways to remove, reduce, or avoid CO2 emissions.

increased global demand for responsibly sourced energy

We believe renewable energy, like wind and solar, are part of a portfolio of climate solutions, but these energy sources are fundamentally constrained by their intermittency (for example solar panels are unable to generate electricity at night).

Our team has deep knowledge of the energy value chain and is well positioned to support a responsible transition to net zero emissions.

Our commitment to Environmental, Social, and Governance (ESG) means unnecessary risks are identified and avoided across each step of the investment lifecycle.

Mission

SUPPORTING A SUSTAINABLE, LOW CARBON ECONOMY

Proactively lowering industrial emissions while responsibly sourcing energy is a practical and immediate step towards a sustainable, low carbon economy.

To us, sustainability is more than a buzzword – it is a critical framework to mitigate risks for our investors, portfolio companies, and future.

We seek to partner with leading energy and industrial decarbonization entrepreneurs that understand the importance of driving towards a more sustainable future.

RESPONSIBLY MANAGING CARBON

IS OUR PATH TO A BETTER,

MORE SUSTAINABLE, WORLD

How We Are Unique

-

Experienced

Energy InvestorsWe are advocates for the energy industry and have a history of investing in and growing energy companies for over two decades.

-

Experienced

OperatorsOur investment team and advisors have decades of combined experience as executives leading energy companies through periods of high growth.

-

Technical

CapabilitiesGiven the technical nature of the industries we engage with, we have a team of engineers and geologists that provide value to our portfolio companies and investment processes.

-

Deep

NetworkOur energy network helps us source not just unique energy opportunities, but also decarbonization opportunities as these successful entrepreneurs bring their relevant skillsets to solve for the transition to net zero.

-

Responsible

InvestingOur stringent EGS stewardship manages risks by identifying pitfalls of unsustainable business models. We seek to invest in businesses that make the world better.